Global Venture Capital | 2024 Q1

AUG 2024

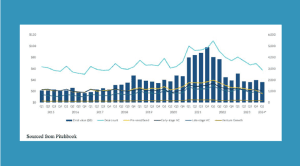

The first quarter of 2024 saw a continuing decline in overall deal activity across the U.S. and abroad. According to investment data pulled from Pitchbook, global deal count in the venture capital sector fell to a near five-year low. The NVCA reported similar statistics for U.S. based deals, signifying the venture funding rebound founders are hoping for might be slightly delayed. However, North American venture dollar volume did see a 14% increase from the last quarter of 2023, according to Crunchbase, indicating some investors remain active and are willing to deploy their cash reserves that were accumulated over the previous years.

Meanwhile, an early wave of IPOs helped boost excitement on the exit front, thanks to Reddit and Astera Labs. A handful of acquisitions also drove such anticipation. As we identified in our 2024 market outlook, the reopening of the IPO market can set the stage for a booming 2025. As North America saw an increase in exit activity from its last quarter, exit activity on the global front continued to decline. Nevertheless, if 2024 continues to follow the trends recognized in 2023, this year’s second and third quarters should show an uptick in M&A transactions. Lasting headwinds from last year deriving from geopolitical instability and this year’s U.S. election in addition to relatively high (and stubborn) levels of inflation—as witnessed by the unexpected increase in the March U.S. CPI—and interest rates, continue to fuel uncertainty for a potential market return.

Meanwhile, an early wave of IPOs helped boost excitement on the exit front, thanks to Reddit and Astera Labs. A handful of acquisitions also drove such anticipation. As we identified in our 2024 market outlook, the reopening of the IPO market can set the stage for a booming 2025. As North America saw an increase in exit activity from its last quarter, exit activity on the global front continued to decline. Nevertheless, if 2024 continues to follow the trends recognized in 2023, this year’s second and third quarters should show an uptick in M&A transactions. Lasting headwinds from last year deriving from geopolitical instability and this year’s U.S. election in addition to relatively high (and stubborn) levels of inflation—as witnessed by the unexpected increase in the March U.S. CPI—and interest rates, continue to fuel uncertainty for a potential market return.

As many predicted, AI startups continue to lead the venture funding sector and did not experience the sharp decline in funding and activity the overall venture capital market did. According to Reuters, AI start-ups raised $42.5 billion in 2023 (a slight decrease from 2022, but nowhere near the 42% decline the overall venture capital market saw). An increase in AI start-up funding for this quarter continues to lead the hope for a funding rebound in the technology sector. Digital health startups have also done particularly well in Q1, with funding up 48% (driven by multiple mega-rounds in biotech). In the fintech sector, funding was down 16% from the last quarter but there was a slight increase in deal activity. Across all sectors though, VCs are seeking sustainable business models and evidence of profitability and scalability. Venture capital fundraising remains slow. A decade low $9.3 billion was raised in Q1, representing just 11.3% of the total funds raised in the 2023 market. If exit activity picks up, there may be more capital available for LPs to reinvest, which should positively impact the VC market sector.

Imprint

Contributed by / Authors

Joshua Buhler

Buhler Duggal & Henry LLP

New York

www.bdhllp.com

Published by

ALLIURIS A.S.B.L.

Alliance of International Business Lawyers

Avenue des Arts 56,

B-1000 Brussels / Belgium

Editors

Chief editor (responsible): Ulrich Herfurth

Management

ALLIURIS A.S.B.L.

Luisenstr. 5

D-30159 Hannover

Fon ++49 511 30756-0

Fax ++49 511 30756-10

Mail info@alliuris.org

Web www.alliuris.org

+++