M&A 2024 Q2 Report

AUG 2024

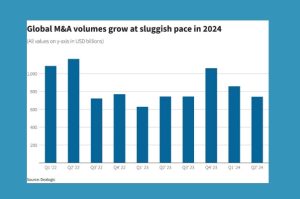

Although many prognosticators were bullish regarding the prospects for mergers and acquisitions (M&A) activity in 2024 following the increased deal levels seen during the final quarter of 2023 and the very beginning of this year, the results have been a mixed bag thus far. Per PwC, total global deal volumes for the first half of 2024 were down 30% compared to the first half of 2023 to just over 21,000, but deal values on the other hand actually grew by 5% to $1.3 trillion, mostly driven by megadeal activity—transactions with values in excess of $10 billion—in the technology and energy sectors. Within the Americas region, deal volumes decreased by 34% year-over-year, but deal values increased by 29%. Specifically with respect to the second quarter, Reuters reported that, based on data from Dealogic, the number of deals signed globally fell 21% to 7,949, whereas deal values grew 3.7% to $769.1 billion. The change in activity levels was not uniform across regions, however, as U.S. M&A volumes were down 3% during this time period, but deal activity in Europe rebounded and jumped 27%. Deal volumes in the Asia-Pacific region fell 18%.

The downturn in deal making has been driven by a number of persistent factors. Although market participants as of the beginning of 2024 widely believed that interest rates were at their peak and expected to decline in short order, most central banks maintained such rates higher for longer than anticipated, due to the stubborn relatively elevated levels of inflation still being experienced throughout the globe. These higher interest rates—which increase the cost of capital for borrowers looking to finance M&A transactions—have had a sustaining chilling effect on the market. Moreover, there remains a significant gap in valuation expectations between buyers and sellers in many sectors, which has been exacerbated in some respects by the well-performing public equity markets. Finally, certain non-economic factors continue to dampen enthusiasm for undertaking potentially risky M&A transactions—namely, the sustained geopolitical instability in the Middle East and Ukraine; turbulent Sino U.S. relations; and the uncertainty regarding election outcomes in a number of key jurisdictions.

The downturn in deal making has been driven by a number of persistent factors. Although market participants as of the beginning of 2024 widely believed that interest rates were at their peak and expected to decline in short order, most central banks maintained such rates higher for longer than anticipated, due to the stubborn relatively elevated levels of inflation still being experienced throughout the globe. These higher interest rates—which increase the cost of capital for borrowers looking to finance M&A transactions—have had a sustaining chilling effect on the market. Moreover, there remains a significant gap in valuation expectations between buyers and sellers in many sectors, which has been exacerbated in some respects by the well-performing public equity markets. Finally, certain non-economic factors continue to dampen enthusiasm for undertaking potentially risky M&A transactions—namely, the sustained geopolitical instability in the Middle East and Ukraine; turbulent Sino U.S. relations; and the uncertainty regarding election outcomes in a number of key jurisdictions.

Despite these headwinds, many market participants remain hopeful that a surge in M&A activity is on the near horizon. Recent interest rate cuts announced by the European Central Bank as well as central banks in Switzerland, Sweden and Canada have renewed hopes that inflation may be getting under control and that further rate cuts are afoot globally. These cuts would allow businesses to access capital at relatively favorable costs, thus encouraging investment and likely fostering enhanced M&A activity. Moreover, many potential buyers (including both private equity firms and strategics) are still sitting on and looking—if not needing, especially in the case of private equity firms obligated to use or lose their limited partners’ capital—to deploy vast cash reserves that were accumulated over the 2020-2022 period, which could provide the capital necessary to undertake M&A activity without the need for additional financing. Regarding election uncertainty, several major jurisdictions—including India, the United Kingdom and France—have recently conducted their elections, and market participants will soon have a clearer view on the economic policies to be pursued in those territories. Although there remains significant uncertainty regarding the future political situation in the United States, that, too, should be resolved in the coming months. For all these reasons, there exists reasonable grounds to believe that the remainder of 2024 will see a more welcoming environment for M&A activity.

Imprint

Contributed by / Authors

Joshua Buhler

Buhler Duggal & Henry LLP

New York

www.bdhllp.com

Published by

ALLIURIS A.S.B.L.

Alliance of International Business Lawyers

Avenue des Arts 56,

B-1000 Brussels / Belgium

Editors

Chief editor (responsible): Ulrich Herfurth

Management

ALLIURIS A.S.B.L.

Luisenstr. 5

D-30159 Hannover

Fon ++49 511 30756-0

Fax ++49 511 30756-10

Mail info@alliuris.org

Web www.alliuris.org

+++