Venture Capital 2024 Q2 Report

AUG 2024

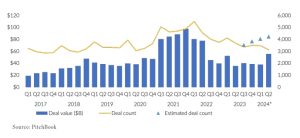

The first half of 2024 has proven to show how resilient the venture capital market is. According to Reuters, the second quarter saw over $55 billion in venture capital funding, making it the highest quarter of funding over the past two years. Investment data pulled from Pitchbook has also shown an overall increase in venture capital deal value in the European market and across the globe. Carta confirmed, in their first cut of data for the quarter, that the median amount of cash raised was about the same from seed through Series C after rising from last year’s historic fundraising lows. Though encouraging, such record numbers have been the result of several highly valued transactions, as overall deal count is still on the decline.

The IPO excitement we saw in the first quarter of the year has calmed. Exit activity this past quarter has been driven by much smaller deals. However, overall exit activity has remained constant compared to the year’s first quarter (Tempus and Rubrik were two notable IPOs driving U.S. exit activity in the second quarter). Although we remain optimistic that the reopening of the IPO market could set the stage for a booming 2025, the current U.S. presidential election cycle and geopolitical instability in the Middle East and Ukraine will likely continue to fuel uncertainty for the second half of 2024.

The IPO excitement we saw in the first quarter of the year has calmed. Exit activity this past quarter has been driven by much smaller deals. However, overall exit activity has remained constant compared to the year’s first quarter (Tempus and Rubrik were two notable IPOs driving U.S. exit activity in the second quarter). Although we remain optimistic that the reopening of the IPO market could set the stage for a booming 2025, the current U.S. presidential election cycle and geopolitical instability in the Middle East and Ukraine will likely continue to fuel uncertainty for the second half of 2024.

AI continues to lead the charge in venture capital fundraising. According to The FinTech Times, AI startups have captured 28% of all venture funding this past quarter. Apple’s recent announcement regarding integrating AI into its software is just one example of new developments to come in the industry. As additional commercial uses for AI become apparent, venture capital firms will continue to target startups with innovative approaches for such uses. Furthermore, exit activity numbers are poised to benefit from the recent flux of AI startups, as we may see a number of acquisitions in the second half of the year due to a growing appetite from larger companies looking to benefit from AI generated software with the funds to acquire such startups. While the second quarter did see an increase in the total amount raised in the U.S. venture market, there was a 10% decrease in deal count. If exit activity picks up as expected, there would be more capital available for LPs to reinvest, which should continue to positively impact the VC market sector.

Imprint

Contributed by / Authors

Joshua Buhler

Buhler Duggal & Henry LLP

New York

www.bdhllp.com

Published by

ALLIURIS A.S.B.L.

Alliance of International Business Lawyers

Avenue des Arts 56,

B-1000 Brussels / Belgium

Editors

Chief editor (responsible): Ulrich Herfurth

Management

ALLIURIS A.S.B.L.

Luisenstr. 5

D-30159 Hannover

Fon ++49 511 30756-0

Fax ++49 511 30756-10

Mail info@alliuris.org

Web www.alliuris.org

+++