M&A Report 2024-Q1

By Buhler Duggal & Henry LLP

AUG 2024

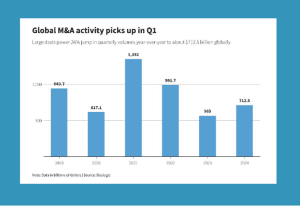

20.08.2024 | As many prognosticators had predicted following the uptick in mergers and acquisitions (M&A) activity during the final quarter of 2023, the beginning of 2024 saw a rise in year-over-year M&A transaction levels, particularly with respect to mega deals (those with values of at least $10 billion). Per Reuters, based on recent data from Dealogic, total global M&A volumes for the first quarter climbed 30% to over $750 billion compared to the same period last year, which included 14 mega deals in 2024, versus five in 2023. This rise in activity was not uniform across regions, however, as M&A volumes increased in the United States and Europe by 59% and 64%, respectively, whereas they decreased by 40% in the Asia Pacific region. The two sectors in particular that have been at the forefront of this enhanced deal making are oil and gas and technology, the latter of which saw an increase in volumes of more than 42% to over $150 billion.

The upturn in deal making has been driven by a number of factors. Strong corporate earnings and renewed economic optimism in general have helped fuel a recent surge in equity markets, which in turn has increased the value of buyers’ equity consideration in M&A transactions and has helped offset the continued elevated financing costs that subdued activity during the second half of 2022 and most of 2023. Moreover, many potential buyers (including both private equity firms and strategics) are still sitting on and looking —if not needing—to deploy vast cash reserves that were accumulated over the 2020-2022 period, and the more favorable current economic climate has helped encourage certain of them to use these reserves to pursue high-value targets. Finally, market participants are still expecting central banks around the globe to implement interest rate cuts in the near future, which would allow businesses to access capital at relatively favorable costs, thus encouraging investment and likely fostering even further enhanced M&A activity. Although these cuts have yet to fully materialize in most jurisdictions, their potential alone has contributed to a more optimistic economic outlook, which has helped exacerbate deal making in and of itself. While first quarter M&A volumes are certainly improved compared to the same period last year, the market still faces a few headwinds that are helping to prevent a return to the activity levels that existed prior to the beginning of the global interest rate hiking cycle in mid-2022. These headwinds include relatively high (and stubborn) levels of inflation–as witnessed by the unexpected increase in the March U.S. CPI–and interest rates, increased regulatory scrutiny in a number of jurisdictions, geopolitical instability, and uncertainty regarding election outcomes in a number of key jurisdictions. Nevertheless, the data thus far shows that participants are generally choosing to focus on the positive trends in the marketplace, and that 2024 appears set to be characterized by increased M&A transaction activity and enhanced economic growth.

+++

Imprint

Contributed by / Authors

Joshua Buhler

Buhler Duggal & Henry LLP

New York

www.bdhllp.com

Published by

ALLIURIS A.S.B.L.

Alliance of International Business Lawyers

Avenue des Arts 56,

B-1000 Brussels / Belgium

Editors

Chief editor (responsible): Ulrich Herfurth

Management

ALLIURIS A.S.B.L.

Luisenstr. 5

D-30159 Hannover

Fon ++49 511 30756-0

Fax ++49 511 30756-10

Mail info@alliuris.org

Web www.alliuris.org