M&A Report 2024-Q4

FEB 2025

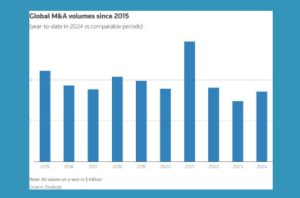

While 2024 saw a welcome increase in mergers and acquisitions (M&A) activity over 2023’s tepid levels, the optimistic expectations for a burst in deal making that existed at the beginning of the year ultimately did not materialize. Market participants had been hopeful that declining inflation leading to decreased interest rates globally, an aggressive return to transactional activity from private equity firms, increased pressure on buyers and sellers to bridge persistent valuation gaps, and the resolution of elections in many notable jurisdictions, would all help spur a robust M&A environment. Although some of these factors bore out—including reduced inflation leading to limited interest rate reductions during the second half of the year and an increase in private equity activity— certain headwinds such as geopolitical instability, enhanced antitrust scrutiny, and continued elevated interest rates compared to pre-pandemic times, all continued to adversely affect the market.

Reuters reported that, based on data from Dealogic, the total value of deals globally as of late December 2024 totaled $3.45 trillion, up 15% from the year-earlier period. In the U.S., M&A volumes climbed 10% to $1.55 trillion as of such date, while the increases in the Asia-Pacific region and Europe amounted to 11% and 22%, respectively, with volumes in both areas totaling around $800 billion. Per Mergermarket data, the technology sector experienced $640 billion in M&A activity in 2024, a 16% increase versus 2023, driven principally by the strong enthusiasm for artificial intelligence (AI) and machine learning technologies. Notably, the value of private equity deal activity increased by 34% in 2024, with technology deals accounting for 32% of buyout value. Although overall M&A deal count fell in 2024 compared with 2023, the number of announced large deals worth over $10 billion actually increased to 37 from 32, despite the enhanced regulatory scrutiny of such transactions in many jurisdictions.

Reuters reported that, based on data from Dealogic, the total value of deals globally as of late December 2024 totaled $3.45 trillion, up 15% from the year-earlier period. In the U.S., M&A volumes climbed 10% to $1.55 trillion as of such date, while the increases in the Asia-Pacific region and Europe amounted to 11% and 22%, respectively, with volumes in both areas totaling around $800 billion. Per Mergermarket data, the technology sector experienced $640 billion in M&A activity in 2024, a 16% increase versus 2023, driven principally by the strong enthusiasm for artificial intelligence (AI) and machine learning technologies. Notably, the value of private equity deal activity increased by 34% in 2024, with technology deals accounting for 32% of buyout value. Although overall M&A deal count fell in 2024 compared with 2023, the number of announced large deals worth over $10 billion actually increased to 37 from 32, despite the enhanced regulatory scrutiny of such transactions in many jurisdictions.

Despite 2024’s somewhat choppy results, market sentiment regarding expected M&A activity in 2025 is optimistic for a number of reasons. Participants have been buoyed by the results of the recent U.S. elections and the expectation that the Trump administration, supported by a Republican-led Congress, will adopt more business- and deal-friendly policies than the Biden administration, particularly with respect to corporate tax cuts, antitrust review of many M&A transactions, and other regulatory matters. From an inflation perspective, although overall inflation in the U.S. rose slightly in December 2024 compared to the preceding month, the rate is much reduced from the elevated figures that have characterized most of the past couple of years. While there exists some concern regarding the pro-inflationary impact that the Trump administration’s proposed tax and tariff policies could have, the Federal Reserve and other central banks have indicated that they remain ready and willing to consider further cuts to the persistently high interest rates that remain in effect throughout the world. These cuts would allow businesses to access capital at relatively favorable costs, thus encouraging investment and likely fostering enhanced M&A activity.

Moreover, many potential buyers (including both private equity firms and strategics) are still sitting on and looking—if not needing, especially in the case of private equity firms obligated to use or lose their limited partners’ capital—to deploy vast cash reserves that were accumulated over the past few years, which could provide the capital necessary to undertake M&A activity without the need for additional financing. Finally, there exists increasing hope that certain devastating geopolitical events, such as the Israel-Hamas and Russia-Ukraine conflicts, may be nearing a conclusion, which would help to achieve more global stability. While the headwinds that have mostly characterized the market for the past couple of years resulted in a backlog in the M&A pipeline, the expectation is that as these headwinds continue to subside, conditions will be ripe for a surge of activity

+++

Imprint

Contributed by / Authors

Joshua Buhler

Buhler Duggal & Henry LLP

New York

www.bdhllp.com

Published by

ALLIURIS A.S.B.L.

Alliance of International Business Lawyers

Avenue des Arts 56,

B-1000 Brussels / Belgium

Editors

Chief editor (responsible): Ulrich Herfurth

Management

ALLIURIS A.S.B.L.

Luisenstr. 5

D-30159 Hannover

Fon ++49 511 30756-0

Fax ++49 511 30756-10

Mail info@alliuris.org

Web www.alliuris.org