Venture Capital Report 2024-Q4

FEB 2025

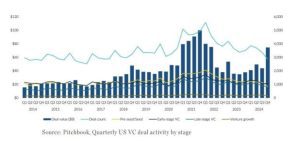

The last quarter of 2024 solidified AI’s current influence in the venture capital market. AI companies raised all of the top five venture deals of the year, with four closing in Q4 24 alone — driving a two-year high in quarterly funding. Nevertheless, quarterly deal volume steadily declined through the end of 2024, slipping below 6,000 in Q4 2024 for the first time since 2016. This downturn was particularly noticeable in countries like China, Canada, and Germany. Yet, some Asian countries, including Japan, India, and South Korea, saw a notable increase in deal activity. Overall, 2024 fell short of expectations, with few exits and limited returns which continued to hinder global fundraising as LPs remain cautious. However, the year saw a slight increase in US investments compared to 2023, fueled by the large amount of dry powder reserves and a growing interest in AI. Early-stage deal valuations hit a record median of $25 million in 2024, with Seed and Series A rounds dominating the year’s overall deal activity.

AI companies accounted for 37% of 2024 venture funding and 17% of deals—both of which were all-time highs, according to CB Insights. Nearly 74% of AI deals were early-stage, however, overall growth was driven largely by AI infrastructure companies, with major financing rounds from companies like Databricks, OpenAI, xAI, and Anthropic. Such deals are responsible for the 53% increase in funding in Q4 2024 as compared to Q3 2024 (60% of the funding in Q4 came from deals worth $100M+).

AI companies accounted for 37% of 2024 venture funding and 17% of deals—both of which were all-time highs, according to CB Insights. Nearly 74% of AI deals were early-stage, however, overall growth was driven largely by AI infrastructure companies, with major financing rounds from companies like Databricks, OpenAI, xAI, and Anthropic. Such deals are responsible for the 53% increase in funding in Q4 2024 as compared to Q3 2024 (60% of the funding in Q4 came from deals worth $100M+).

Despite the lack of a full recovery in 2024, the outlook for 2025 appears promising with the potential for distribution yields to rise for the first time since peaking in Q3 2021. Recent distribution yields have been among the lowest in history, but such downturn is primarily a result of continuous rapid market shifts. The surge in exits between 2020 and 2021 created unusually high distributions, but the market’s aftermath left many companies with inflated valuations, stalling exit opportunities.

As the market stabilizes, increased IPO and M&A activity in 2025 is expected to offer more exit opportunities, especially with a sizable pool of mature unicorns ready to go public. IPO timelines have significantly lengthened, with venture capital-backed companies that went public in 2024 waiting a median of 7.5 years from their first funding round to their IPO. This marks a two-year delay compared to 2022, as many late-stage companies chose to delay their public market debut in favor of raising additional private funding to sustain growth and create liquidity for early investors and employees. Companies like Stripe and Databricks, which are privately held, have chosen to raise more private equity or sell private shares instead of pursuing an IPO in the current market.

According to PitchBook, venture capital fundraising in 2025 is projected to reach approximately $90 billion, up from $71 billion in 2024, but challenges remain, particularly for smaller and first-time funds. The changing dynamics—selective investments, new exit strategies, and regulatory shifts under the incoming administration—could help alleviate liquidity issues and support a gradual recovery. Nevertheless, the market’s evolution may lead to more complex liquidity solutions, restructuring how venture funds manage exits and distributions going forward.

In addition to the top-line valuations remaining strong in a few key verticals, across all industries we continue to see novel structures across investment instruments: including pay-to-play incentives, structured debt and highly negotiated convertibles, often including warrants or other implications of valuation corrections. Many companies and investors are considering interim and opportunistic capital raises outside of a typical priced round. Your BDH team would be happy to discuss any unconventional (or conventional) routes to ensure your company or portfolio’s capital requirements are addressed.

Beyond the fundraising environment, do also consider reaching out to your BDH attorneys if you need assistance on any commercial matters. Among other reasons, having the resources to negotiate a few key terms in your commercial agreements can present significant value if you are considering an M&A opportunity or due to other reasons, need to terminate a significant contract. Even in a fundraising scenario, having familiarity of the key terms and any bespoke issues in your material contracts can result in efficiency.

+++

Imprint

Contributed by / Authors

Joshua Buhler

Buhler Duggal & Henry LLP

New York

www.bdhllp.com

Published by

ALLIURIS A.S.B.L.

Alliance of International Business Lawyers

Avenue des Arts 56,

B-1000 Brussels / Belgium

Editors

Chief editor (responsible): Ulrich Herfurth

Management

ALLIURIS A.S.B.L.

Luisenstr. 5

D-30159 Hannover

Fon ++49 511 30756-0

Fax ++49 511 30756-10

Mail info@alliuris.org

Web www.alliuris.org